Enterprise-grade portfolio analytics translated.

SRL Analytics is a powerful online software platform for portfolio and investment analytics, designed to help you make informed decisions when comparing & analysing portfolios and investment products.

Our suite of quantitative tools cover Portfolio Modelling and Backtesting, Monte Carlo Simulations, Portfolio Optimisation, Factor Models, and Tactical Asset Allocation Models.

“SRL Analytics turns complex analytics into powerful insights by coupling sophisticated financial modelling, intuitive visualisations, and AI generated commentary.”

Tuomo Lampinen, CEO, SRL Analytics

Insightful. Clear. Liberating.

- Compare portfolio managers’ performance

- Understand risk exposures and return drivers with factor analysis

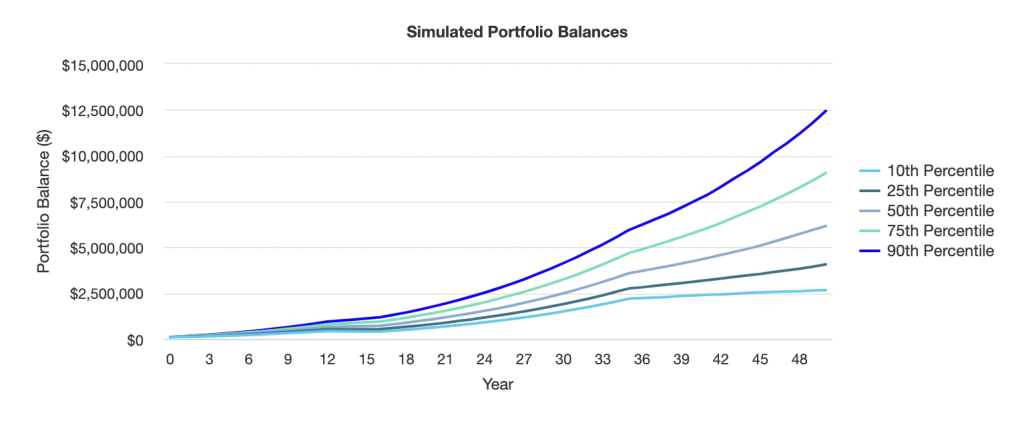

- Simulate and stress-test portfolio growth and survival

- Monte-Carlo and parametric simulations

- Analyse portfolio impact of different capital market assumptions

- Optimise portfolio based on targeted return, risk, and constraints

Configure SRL Analytics to suit your specific needs.

Choose Your Module/s

Model forward cashflows and simulate expected portfolio growth based on historical or forecasted returns. Better understand the investors’ likelihood to realise their financial goals and meet liabilities.

Screen and compare available managers and securities in order to manage risk and make better informed investment decisions.

Create and compare different portfolio models based on periodically rebalanced, strategic asset allocations; optimization strategies; or tactical asset allocation models ‐ and align investments with financial goals and liabilities.

Analyze risk and return metrics of your portfolio model and understand the sources of those returns and risks.

Choose Your Data Plan/s

| DEVELOPED | EMERGING | ||||

| Americas | Europe | Asia Pacific | Americas | EMEA | Asia Pacific |

| Canada | Austria | Australia | Brazil | Czech Republic | China |

| USA | Belgium | HK | Chile | Egypt | India |

| Denmark | Japan | Columbia | Greece | Indonesia | |

| Finland | NZ | Mexico | Hungary | Korea | |

| France | Singapore | Peru | Kuwait | Malaysia | |

| Germany | Poland | Philippines | |||

| Ireland | Qatar | Taiwan | |||

| Italy | Saudi Arabia | Thailand | |||

| Netherlands | South Africa | Isreal | |||

| Norway | Turkey | ||||

| Portugal | UAE | ||||

| Spain | Isreal | ||||

| Sweden | |||||

| Switzerland | |||||

| UK |

All

All

Large & Mid Cap Listed Equities & ETFs & Mutual Funds + Alternatives

Developed

Americas

Large & Mid Cap Listed Equities & ETFs & Mutual Funds

Europe

Large & Mid Cap Listed Equities & ETFs

Asia Pacific

Large & Mid Cap Listed Equities & ETFs

Emerging

All

Americas

Large & Mid Cap Listed Equities & ETFs

EMEA

Large & Mid Cap Listed Equities & ETFs

Asia Pacific

Large & Mid Cap Listed Equities & ETFs

Alternative

Digital

Crypto

Portfolio Analytics Masterclass: Autumn Series

Virtually join members of the SRL Innovations Team at a Portfolio Analytics Masterclass and find out just how powerful the SRL Analytics software really is. We’ll take you through a short series of scenarios and simulations designed to help you better understand and communicate your financial universe.

Modelling Laboratory

Exclusively for Professional Investors and Asset Managers – our Modelling Laboratory allows users to develop and test trading and portfolio management models that either generate alpha (excess return over benchmark) or offer better risk adjusted returns (downside protection with good upside capture).

Modelling Laboratory

Exclusively for Professional Investors and Asset Managers – our Modelling Laboratory allows users to develop and test trading and portfolio management models that either generate alpha (excess return over benchmark) or offer better risk adjusted returns (downside protection with good upside capture).